Article Directory

The "Sleeping Giant" That Might Just Put Your Portfolio to Sleep Forever

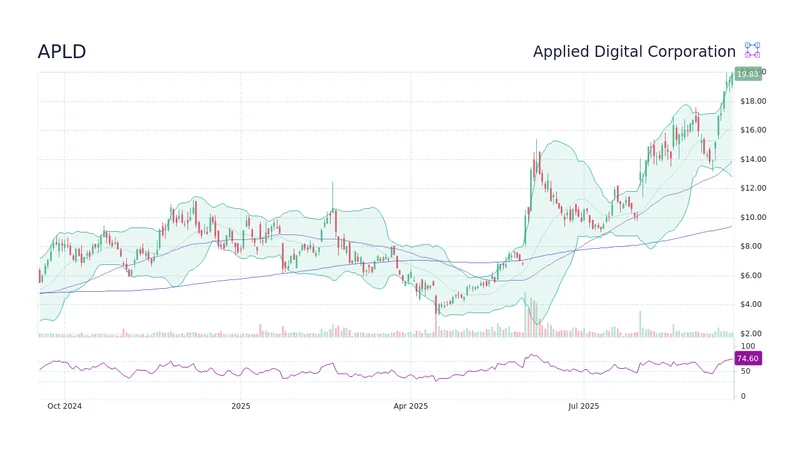

Alright, let's talk about "sleeping giants." Usually, that's a metaphor for some untapped potential, a powerhouse just waiting to wake up and dominate. But when some "analyst" from "PropNotes" starts slinging that phrase around about a stock like Applied Digital (APLD), promising "high-yield investment opportunities" and "expert research you won't find anywhere else," my BS detector goes into a five-alarm meltdown. 'Cause, let's be real, most "sleeping giants" in the stock market are just dead weight, and the only thing they're putting to sleep is your retirement fund.

You see this kind of drivel all over the internet, right? Some rando pops up, calls themselves an "expert," and suddenly they're dishing out advice that's supposedly gonna make you rich. And Applied Digital Is A Sleeping Data Center Giant (NASDAQ:APLD), found over on Seeking Alpha, is a masterclass in how to sound official while simultaneously waving enough red flags to choke a bull. They want you to believe they're making "complex concepts easy to understand," but what they're actually doing is making self-serving pitches sound palatable. It ain't rocket science, folks; it's just the same old song and dance, dressed up in a new suit.

The Emperor's New Clothes: "Expert" Advice and Dodgy Disclosures

So, this "PropNotes" outfit, with their fancy name that screams "we're totally legitimate, trust us," claims they've got this unique insight into APLD, calling it Applied Digital Is A Sleeping Data Center Giant (NASDAQ:APLD). Sounds great, right? Who doesn't want to get in on the ground floor of the next big thing, especially with all the hype around `nvda`, `nvidia stock`, `amd stock`, and other tech darlings? But then you scroll down, past the fluff, and you hit the analyst's disclosure. And that's where the real story starts to unravel like a cheap sweater.

"I/we have a beneficial long position in the shares of APLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions." Oh, your opinions? You don't say. And you just happened to be long on the stock you're hyping? What a shocking coincidence! This ain't "expert research," my friends; it's a promotional piece for their own damn portfolio. It's like a chef telling you his restaurant has the best food in town, then revealing he owns the place and all his friends are investors. You don't need a degree in finance to smell that kind of fish. It makes you wonder about all those other "hot tips" out there, whether it's for `pltr stock`, `sofi stock`, or even the almighty `tesla stock`... are they really about your gains, or someone else's?

And let's not gloss over the fact that they explicitly state they're "not receiving compensation for it (other than from Seeking Alpha)." So, they are getting paid by Seeking Alpha to write these articles. And they're long on the stock. You don't need to be a cynical old hack like me to connect those dots. It's a closed loop, a self-licking ice cream cone where the "analyst" benefits from the attention, the platform gets content, and you, the "individual investor," are left holding the bag if this "sleeping giant" decides to just keep on snoozing, or worse, rolls over and dies.

The Wild West of Online Investing: Who's Watching the Hen House?

Then there's Seeking Alpha's own boilerplate, which almost makes me laugh out loud if I wasn't so damn frustrated by the whole thing. "Past performance is no guarantee of future results." No kidding. "No recommendation or advice is being given as to whether any investment is suitable for a particular investor." Yet, the entire article is framed as an investment opportunity. It's a legal tightrope walk designed to protect themselves while letting these "analysts" run wild. The kicker? "Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body."

Did you catch that? "May not be licensed or certified." So, you've got some dude who's "long" on `apld stock price`, getting paid to write about it, and he might not even have a basic certification. He could be a professional prop trader, sure, or he could be some guy in his pajamas playing stock market roulette, convinced he's found the next `bbai` or `iren` while the rest of us are just... well, suckers. It's the digital equivalent of trusting medical advice from a guy who "read a lot of books" and happens to own a pharmacy. This ain't about making "smart decisions," it's about navigating a minefield blindfolded.

It's tempting to chase those big gains, I get it. Everyone wants to find the next `smci` or `amazon stock` before it blows up. But when the "expert" advice comes with this much self-interest and this little actual accountability, you gotta ask yourself: whose benefit is this really for? Are we truly supposed to believe this is just good-natured sharing of insight, or is it a calculated move to pump a stock that someone already has a vested interest in? I mean, what if this "sleeping giant" is actually just a bear trap, set for unsuspecting retail investors? It's a thought that keeps me up at night... then again, maybe I'm just too cynical for my own good. But then I see this stuff, and I think, "Nah, I ain't cynical enough."