Article Directory

Forget Recession Fears: How the Market's Rate Cut Bets Are Igniting a New Era of Tech Innovation

Market's Rate Cut Bets and Tech Innovation

Okay, friends, buckle up, because what happened in the markets this week isn't just about numbers going up or down. It's about something far bigger: the potential ignition of a whole new era of tech innovation fueled by – get this – lower interest rates. Yes, you heard me right. While everyone's been hyper-focused on recession fears and whether the Fed will blink, the market's actually whispering a different story, a story of unleashing pent-up potential.

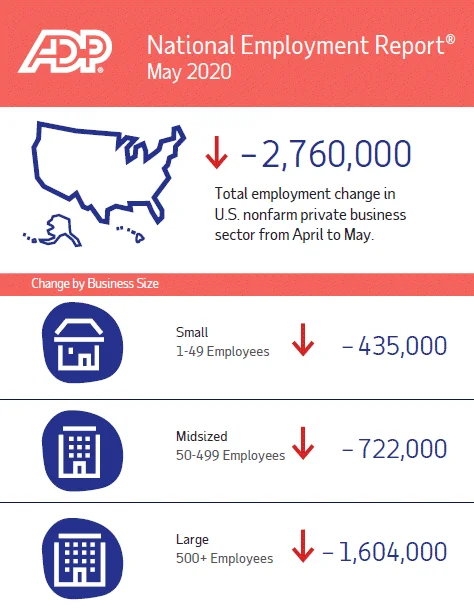

The Dow soared over 400 points, and the S&P 500 and Nasdaq followed suit. The narrative? It all boils down to one thing: investors betting big that the Federal Reserve will cut interest rates next week. The ADP report showing a surprising decline in private payrolls? Instead of sending shivers down spines, it sent rate-cut hopes soaring! It's like the market is saying, "Aha! Proof that the Fed needs to act!" And with an 89% chance of a rate cut now priced in, according to the CME FedWatch tool, it's hard not to get excited. But here's the real kicker: it's not just about the immediate bump. It's about what lower rates unlock.

Unleashing Innovation Through Lower Rates

Think about it. Lower rates mean cheaper borrowing. Cheaper borrowing means companies can invest more in R&D, expand their operations, and, most importantly, take risks on those moonshot ideas that could change everything. It's like turning on the afterburners for the entire tech sector.

Green Shoots of Innovation

And this isn't just some pie-in-the-sky theory. We're already seeing the green shoots. Marvell Technology, for example, jumped almost 8% after its data center growth projections. American Eagle Outfitters rallying around 15%? That's a sign of consumer confidence, which is essential for a thriving economy. Even Bitcoin, that wild child of the investment world, is back above $93,000, signaling a renewed appetite for risk. This all points to a market that's not just shrugging off recession fears, but actively preparing for a new wave of growth.

Benefits for Small Businesses and Startups

But here's the thing: it's not just about the big players. Lower rates disproportionately benefit small businesses and startups. These are the engines of innovation, the places where the craziest, most disruptive ideas are born. Imagine a world where countless startups, freed from the shackles of high-interest debt, can finally bring their visions to life. We're talking about a potential explosion of new technologies, new industries, and new jobs. It's like the roaring twenties, but powered by AI and blockchain instead of jazz and flappers.

Caveats and Competition

Of course, there are always caveats. Microsoft stumbled a bit after reports of AI sales quota cuts, reminding us that even the giants aren't immune to the realities of the market. And as Scott Welch, Certuity's chief investment officer, wisely pointed out, the market is starting to separate the winners from the losers. Not every company will thrive in this new environment. But that's the beauty of capitalism, isn't it? Competition breeds innovation.

The Risk of No Rate Cut

The big question, though, is what happens if the Fed doesn't cut rates? Welch put it bluntly: "The market is hinged on the Fed, and so if they don't cut, it's not going to turn out well." That's a risk, no doubt. But I think the market is betting that the Fed sees the writing on the wall. They know that lower rates are the key to unlocking the next chapter of economic growth, and they're not going to let fear of inflation stand in the way. As reported by CNBC, Dow closes 400 points higher as ADP jobs data strengthens Fed rate cut hopes.

Responsibility and Ethical Implications

But let's pause for a moment. All this potential for innovation comes with a responsibility. As we unleash these powerful new technologies, we need to ensure that they're used for good, that they benefit everyone, not just a select few. We need to think about the ethical implications of AI, the environmental impact of new industries, and the potential for job displacement. It's a challenge, but it's one we must face head-on.

The Dawn of a New Technological Springtime

So, what does this all mean? It means that the market isn't just betting on a rate cut; it's betting on a future. A future where innovation flourishes, where new technologies transform our lives, and where the economy is powered by ingenuity and risk-taking. It's a bold vision, but it's one that I believe is within our reach. And honestly, when I see the market reacting like this, with such palpable excitement, it reminds me why I got into this field in the first place. It's not just about the money; it's about the potential to create a better world. Are we ready for that? I think so.