Article Directory

Let’s get one thing straight. The fact that you’re probably here because you typed “will netflix stock split” into a search bar is the entire problem. It’s a symptom of a sickness, a collective obsession with financial trickery over actual substance. You’re asking the wrong damn question.

Every day, the internet hums with the same desperate queries: when is netflix stock split, netflix stock split 2025, netflix stock split announcement. It’s a mantra for the Robinhood crowd, a prayer whispered in hopes that a meaningless cosmetic change will somehow make them rich.

Give me a break.

A stock split is financial theater. It’s the equivalent of a magician sawing a lady in half. It looks dramatic, but at the end of the day, she’s perfectly fine and you’re still out the price of a ticket. Netflix has one share worth, say, $680. They announce a 10-for-1 split. Now you have ten shares worth $68 each. Did your net worth change? No. Did the company’s value change? No. All that happened is the price tag looks smaller, more palatable for people who get scared by big numbers. It’s a psychological ploy, a marketing gimmick to lure in smaller fish. And the fact that so many people are clamoring for it is, frankly, insulting.

The Shell Game We Keep Falling For

The last time Netflix did this was in 2015. A 7-for-1 split. But 2015 was a different universe. Back then, Netflix was the disruptor, the undisputed king of streaming, a cultural juggernaut burning through cash to build an empire. The biggest threat was… what, Hulu? Cable TV? It was a monster with no equal. A stock split then felt like a victory lap.

Now? Now it feels like a distraction.

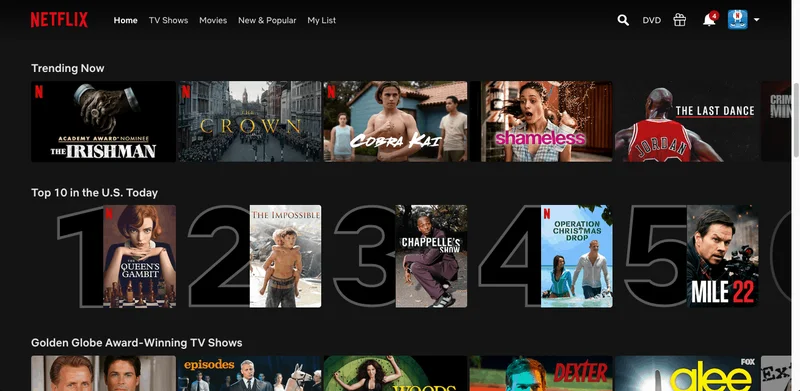

Think about the last time you opened the Netflix app. I mean really thought about it. You scroll past rows of algorithmically-generated thumbnails, a sea of glossy, forgettable faces. A new true-crime doc that feels exactly like the last one. A sci-fi blockbuster with a $200 million budget and the soul of a spreadsheet. A stand-up special from a comedian you’ve never heard of. It’s a content landfill, and we’re paying for the privilege of digging through the trash. This is the company you’re worried about splitting its stock?

The real netflix stock split news isn’t about the stock at all. It’s about the password sharing crackdown, a move that felt less like a smart business decision and more like shaking down your customers for couch change. It’s about the ad-supported tier, which turned the revolutionary, commercial-free promise of streaming into, well, just another version of cable. Its a cheap trick to pump up subscriber numbers that the street seems to love.

So while everyone is asking when will netflix stock split, I’m asking a different question: Has Netflix forgotten how to make things we actually want to watch?

A Sign of Strength or a Whiff of Desperation?

Look, I’m not an idiot. I know why they’d do it. A lower share price makes it easier for employees to manage their stock options and for small-time investors to buy in without resorting to fractional shares. It generates headlines, a flurry of positive press, and a short-term sugar rush for the stock price. A netflix stock split date would dominate the news cycle for a week.

But it’s a bad look. No, 'bad' doesn't cover it—it's a five-alarm dumpster fire of a look. It suggests the C-suite thinks the best way to generate value isn’t by greenlighting the next Stranger Things or Queen's Gambit, but by playing silly games with share counts. They think we're all just day-traders looking for a quick pop, and maybe they're right, which is just... incredibly depressing.

Could a split happen in 2025? Sure. It could happen tomorrow. Management could be sitting in a boardroom in Los Gatos right now, looking at the same search trends you are and deciding to give the people what they want. But it would feel hollow, a move made not from a position of unassailable strength, but from a need to change the conversation.

If your product is so good, if your vision is so clear, you don’t need to resort to parlor tricks. Apple, Amazon, Google—they all did splits when they were on top of the world, when it was an afterthought. For Netflix, right now, it feels less like a coronation and more like a desperate plea for attention.

A Cheap Hit of Dopamine

Let’s be brutally honest. The obsession with a potential Netflix stock split is just a desire for a cheap hit of dopamine. It’s not about long-term value or the company’s creative health. It’s about seeing a headline, watching a number go up, and feeling like you’re part of something. But you’re not. You’re just watching the shells move around on the table, and the house always wins that game. Stop asking when the split will happen and start asking if the company is still worth your subscription, let alone your investment. That’s the only question that actually matters.