Article Directory

ZKsync's Tokenomics Shift: A Desperate Gamble or Genius Move?

ZKsync is proposing a significant overhaul of its ZK token, moving it from a pure governance instrument to one with, supposedly, real economic utility. The idea, as outlined by Alex Gluchowski, is to tie network usage and enterprise licensing directly to the token's value. The question is, can they pull it off, or is this just a desperate attempt to pump a flagging asset?

The core of the proposal centers around two revenue streams: on-chain interoperability fees and off-chain licensing revenue from enterprise tools. Interoperability fees make sense; as the ZKsync ecosystem grows (modular chains, "Prividium" networks, Elastic chain), charging for cross-rollup transfers could generate substantial income. But the devil's in the details. What percentage will these fees be? Will they be competitive with other Layer 2 solutions? And, crucially, how much volume will actually flow through these channels?

The off-chain licensing revenue is even murkier. Selling compliance or reporting modules to institutions sounds good in theory, but it depends entirely on institutional adoption. How many institutions are genuinely clamoring for ZKsync-specific compliance tools? And what's the projected revenue from these licenses? Details remain scarce, but the success of this model hinges on convincing enterprises that ZKsync offers something unique and valuable enough to justify the cost of these licenses.

Olas unveiling Pearl v1, an AI agent app store, and Edge & Node launching ampersend, a management platform for AI agents, are interesting developments in the broader Ethereum ecosystem. But how do these advancements directly benefit ZKsync and its tokenomics? The connection isn't immediately clear, and it feels like tangential news being used to bolster the overall narrative.

The market’s initial reaction was positive, with ZK jumping 14% on the day of the announcement and up 62% on the week (though forward knowledge may have been frontrun, according to ZKsync Proposes Utility and Revenue Focused Tokenomics Shift). But let’s be real: a short-term price spike doesn't equal long-term success. ZK is still down 83% from its all-time high in June 2024. A 14% bounce after an 83% decline is hardly cause for celebration. It's like celebrating a single green day in a bear market. I mean, I’ve looked at hundreds of these charts, and this kind of volatility after a major announcement is pretty standard.

The proposal includes a buyback and burn mechanism, which is supposed to reduce the token supply and increase its value. But buybacks only work if the underlying asset is actually undervalued. If ZKsync is buying back tokens simply to prop up the price without generating real demand, it's just a temporary fix. It's like a company using its cash reserves to artificially inflate its stock price – it might work for a while, but it's not a sustainable strategy.

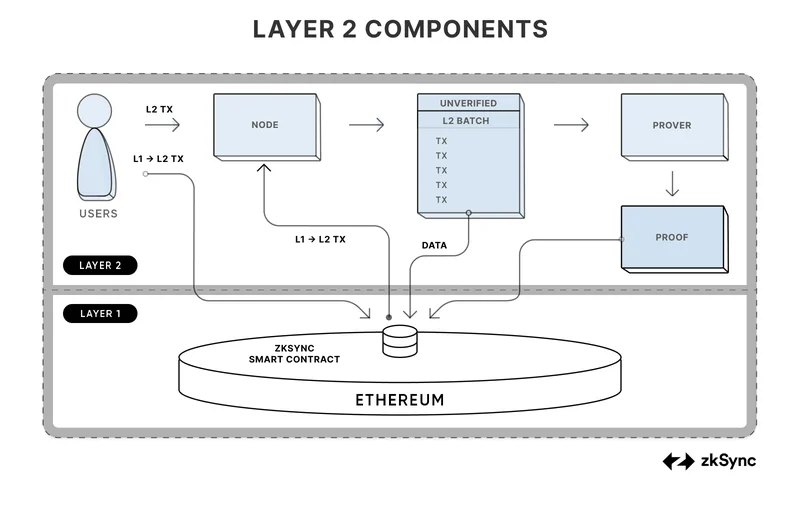

The Atlas upgrade, designed to boost speed, interoperability, and scalability, is definitely a step in the right direction. The promise of 30,000 transactions per second and full Ethereum compatibility is appealing. But other Layer 2 solutions are also making similar advancements. What makes ZKsync's technology superior? What's their competitive advantage? And can they actually deliver on these promises?

The Vitalik Factor: A Blessing or a Curse?

Vitalik Buterin's endorsement of ZKsync, praising its "underrated and valuable" contributions, undoubtedly gave the token a boost. ZK rallied over 50% after Buterin's tweet. But relying on endorsements from influential figures isn't a solid long-term strategy. It's like building a house on sand. What happens when the next shiny new project catches Buterin's eye? Will ZKsync's value plummet again?

And this is the part of the report that I find genuinely puzzling – the reliance on external validation. The project has been doing “a lot of underrated and valuable work” according to Buterin. But if the work is truly valuable, shouldn't the market recognize it organically? Why does it need a co-sign from Vitalik to get a pump? It raises questions about the fundamental strength of the project and its ability to stand on its own merits.

The Trump pardon of Changpeng "CZ" Zhao and Gemini's potential move into prediction markets are interesting developments in the crypto space. But, again, they feel like filler, included to pad out the report without directly contributing to the core analysis of ZKsync's tokenomics.

A Calculated Risk, Not a Sure Thing

ZKsync's tokenomics shift is a bold move, no doubt. But it's far from a guaranteed success. The proposal hinges on several key factors: the actual revenue generated from interoperability fees and enterprise licenses, the competitiveness of ZKsync's technology, and its ability to attract and retain users and institutions. Without concrete data on these factors, it's impossible to definitively say whether this shift will be a game-changer or just another failed attempt to revive a struggling token.

Vaporware or Value?

The ZK token's future hinges on execution, not promises. Until ZKsync can demonstrate a clear path to sustainable revenue and real-world adoption, it remains a speculative asset with a lot to prove.